Distraint Management System

The growing number of distraints that banking institutions receive each day implies the need to automate the process. The distraint process, as the most commonly used means of enforcing debt collection, can be dramatically accelerated and facilitated through the module developed by BankSoft – Distraints . The system we offer can seamlessly be integrated with other external systems, while fully complying with the applicable local / national legislation. An appropriate messaging and query management system would reduce the possibility of making unforeseen errors and help optimize the workflow

The Distraints software aims to automate the main part of the centralized processing of distraints and related documents, which will facilitate the entire process from registering the distraints to the lifting of the imposed distraints and sending letters to the executive government bodies.

The developed by BankSoft distraint messaging and account management system, offers a full set of functionalities that encompass the whole process. The adaptive structure of the system allows integration with the current software systems of the financial or banking institution. Software Distraints offers an instrument for the management of distraint payments. The complete set of nomenclatures allows quick and convenient introduction of new distraints for both financial and banking clients and non-customers. The function of keeping a register of the appellate authorities saves the time for entering accounts to transfer the amounts due to them.

Information system Distraints provides an instrument for quick and easy generating of letters and information required by institutions on the availability of bank accounts of individuals. Additional functionality is the preparation of letters to non-clients of the financial and banking institution.

-

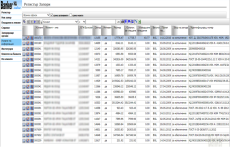

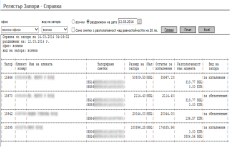

Distraints Index

-

The Distraints system encompasses the entire lifecycle of a distraint - from receiving a letter of distraint of the accounts to the payment of the sums. The record kept and kept information on the arrests of individuals. The module is able to integrate with the banking system and use the data from the bank's client file.

- The distraint information is presented in a tabular form providing a convenient review of the requisites;

- Review and edit of a distraint;

- Generate a notification letter to a client about a distraint;

- Payments on a distraint;

- History of payments;

- History of changes made on a ;

- Registering distraints of non-clients of the banking institution for the purpose of future decision making;

- A large set of search filters.

- Management the status of distraint ocuments - pending confirmation, confirmed, returned for editing, awating cancellation, canceled.

-

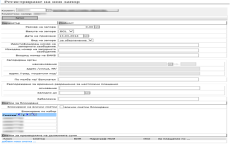

New Distraint

-

Distraints software offers a full set of nomenclatures required to register a distraint. A new distraint can be created for both registered bank customers and non-bank customers. In the event that a person, not a customer of the bank, decides to open an account, a distraint message will appear on his / her registration in the client file. The system provides complete information about the bank products of the person under a distraint message. More than one person may be selected for the distraint. The system gives the possibility of a disturbing message being tied to an already existing distraint. When a distraint is registered, a person is inspected in the Dow Johnes register.

- Amount and currency of each individual distraint - the amount is divided into the fields: Amount by principal and amount by Legal Interest. The system automatically calculates the total amount of the distraint;

- Amount of fees, expenses and others;

- Identity and Outbound Number of the Forwarding Message - the numbers of the distraint message received by the Prepaying Authority;

- Choice of type of distraint - collateral, for execution;

- Obligatory authority - selection from a special register of the appellate bodies (private enforcement agent, NSSI, etc.). When choosing it, it automatically generates the bills where the due amounts can be transferred;

- Request processing;

- Temporary authorization for urgent payments;

- Choice of which client accounts to be blocked - the amount of the seizure is automatically locked regardless of the type of currency on the accounts.

-

Documents

-

All the documents you have entered are stored here. The registry has a detailed document search filter. Data in a registered document can be edited. Notes may also be added to the incoming document. The new note will load as a new line below the text input box.

- Documents can be added to the system by uploading files. Uploaded files can be viewed and sent to a specified e-mail address.

- From the menus in the module can be added different types of documents - outgoing or internal.

- The system keeps a history of changes to each distraint. The user has access to change ID information; type of operation performed; the date and time of the change, and the user who initiated it.

-

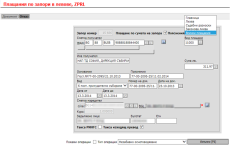

Payment on Distraints

-

When a distraint number is entered in the payment accounting document, the system automatically loads the pre-entered data when registering a distraint.

- Automatic payment is made to the outstanding payment plus the fee for the transfer fee;

- Choice of account if the striking authority or the person in custody has more than one available account;

- Reason - the data for the identifying number of the distraint message (entered during the creation of the distraint);

- Choice of payments - all payments, principal, interest, legal costs, legal interest;

- Transfer orders in the BISERA 6 payment system in connection with the execution of the distraints;

- Status change - when the distraint amount is fully extinguished, the status of Active goes to Status Inactive.

-

Authorization for Temporary Usage

-

For each blocked account, the striking system has the Permit for Temporary Usage functionality - the user may use a portion of the blocked amount.

- The authorization may be a fixed amount or percentage of the proceeds of the account being taken during the period of the authorization;

- Ability to choose the period (s) to which the authorization applies;

- Reason for the authorization;

- Possibility of revision of the permit - extension or shortening of the period; change of amount / percentage.

-

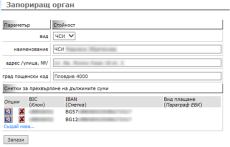

Register of Regulatory Bodies

-

This register introduces the distraint bodies in the country (private enforcement agent, NSSI and others), who have the right to block movable / immovable property. When a strike authority is registered, it can be used when a new distraint is entered into the system, and the billing accounts facilitate the process of generating the payment.

- Detailed information about the distraint body;

- Registration of accounts of the striking body on which the amounts due can be transferred;

- Editing information about a body or accounts.

-

Reports

-

Information System Distraints also includes a statement on the state of the accounts with the purpose of monitoring the sums received on them in a fully summarized and detailed report. By doing so, it is possible to monitor the amounts received in the accounts. The report can be generated:

- Reports of active and lifted distraints;

- To all the offices of the bank or to a particular office (the reference is only for the clients of the bank who are to this office);

- Type of distraint - all types, collateral or executive;

- For all accounts seized or only for moving accounts on a certain date - bills received on that date;

- For accounts with availability above a certain amount;

- References for unsent letters whose expiration date expires;

- Desktop preview or in .xls file (Microsoft Office Excel).

- Report - Documents received;

- Report – cancelled documents;

- Report – payments.

-

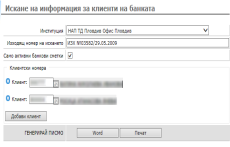

Information Inquiry

-

This part of the system is intended for generating letters of information required by institutions (courts, NRAs, etc.) on the existence of bank accounts for individuals.

- Register of institutions requesting information on distraints;

- In one letter, you can get information about more than one customer;

- Easily and quickly generate mail for individuals who are non-clients of the bank institution;

- Letters could also be written in .doc format (Microsoft Office Word).

Core Advantages of Distraints:

- Full automation on the distraint process;

- Automatic re-evaluation of the distraints;

- Integration with the other information systems in the bank;

- A large set of reports and search filters;

- Ability to enter different nomenclatures;

- Improving workflow processes and effiency.